Economic Development Summary

Fort Bend County works in partnership with local cities and taxing entities to offer tax abatements as a strategic tool for promoting economic development and encouraging private sector investment. These incentives, available under Chapter 312 of the Texas Tax Code, are reviewed on a case-by-case basis by the Fort Bend County Commissioners Court using the County’s most recent Tax Abatement Guidelines, last updated in June 2025. Projects receiving abatements since 2020 have supported business attraction and expansion, resulting in sustained job creation and broader economic benefits countywide.

In evaluating each request, the County considers factors such as the size of capital investment in real and personal property, the number and quality of jobs created or retained, employee compensation and benefits, and the overall community impact. From 2020 through 2024, Fort Bend County approved several key abatement agreements across industries including renewable energy, logistics, and manufacturing industries that contribute to infrastructure development, sustainability, and innovation.

In addition to abatements, the County also uses complementary tools such as Tax Increment Reinvestment Zones (TIRZ) and County Assistance Districts (CAD) to finance infrastructure and foster a business-friendly environment. More details on these programs are available on the Fort Bend County Economic Opportunity & Development webpage.

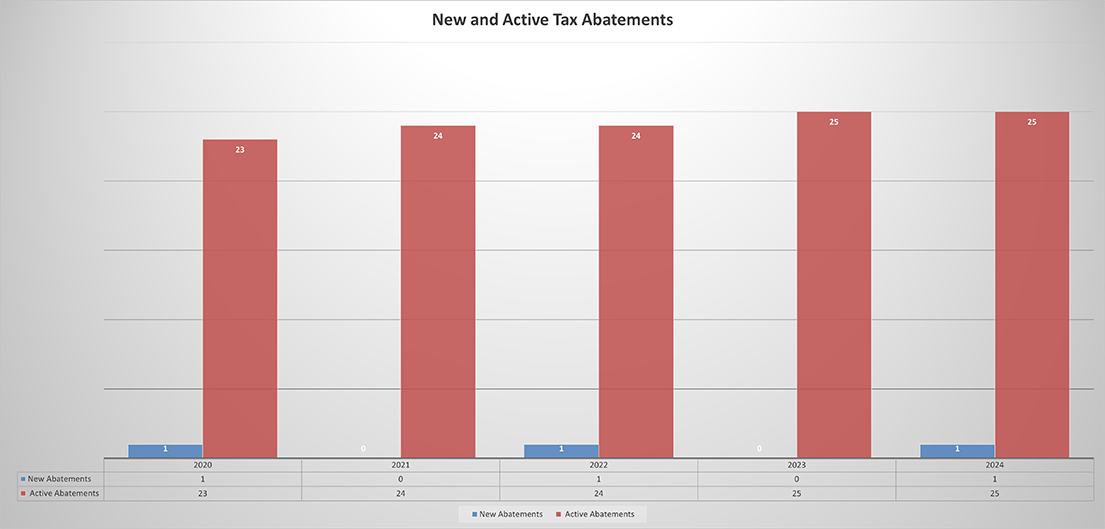

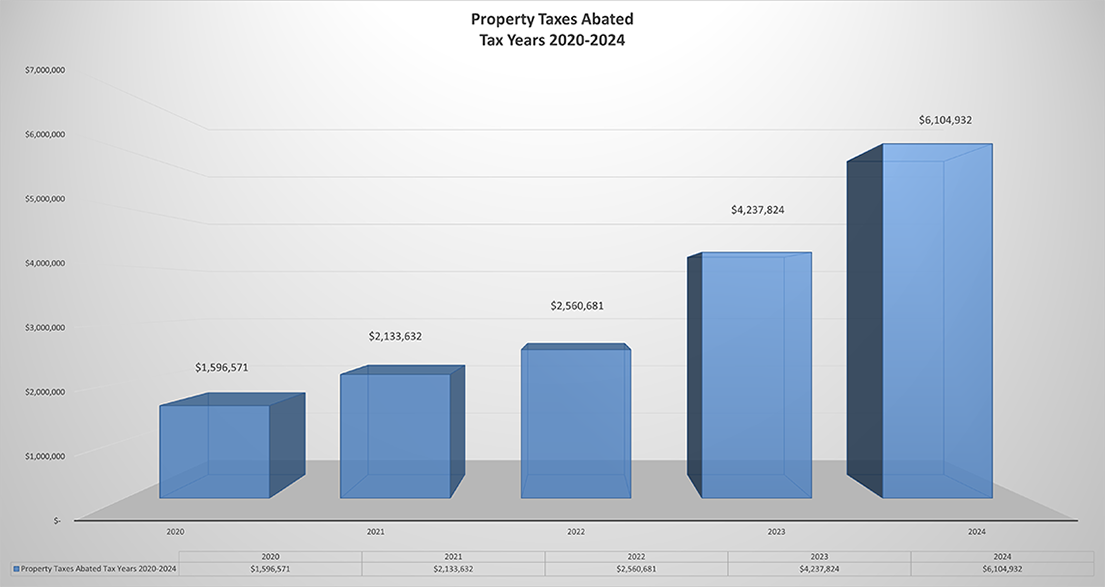

In 2024, Fort Bend County managed a total of 25 tax abatements, one (1) new and 25 active agreements. The charts below highlight trends from Tax Years 2020 – 2024, showing the number of new and active abatements and total property taxes abated. The key economic indicators like estimated taxes abated (total and per capita) in the first year and over the life of the agreements, as well as the number of jobs created and total capital investment to date can be found in the Tax Abatement Dataset document in the downloadable data section.

Downloadable Data

- Tax Abatement Dataset [XLSX]

- Chapter 381 Agreement dataset [XLSX]

Documents

Other Helpful Tools

- GASB Guidance Document – Statement 77 Regarding Tax Abatement Disclosure [PDF]

- Chapter 381 Agreements

- Parkway Lakes Master Economic Development Agreement [PDF]

- First Amendment to Parkway Lakes Master Economic Development Agreement [PDF]

- Second Amendment to Parkway Lakes Master Economic Development Agreement [PDF]

- FBC MUD 216 Development Agreement [PDF]

- Resolution Approving Agreement with EFCDA [PDF]

- Monitoring Performance [PDF]

Abatement Agreements

- 827 Wanamaker & Warren Valve [PDF]

- Aldi (Texas) LLC [PDF]

- AP Solar 2 LLC [PDF]

- API Realty LLC & Accredo Packaging Inc [PDF]

- API Realty LLC Bldg 1-4 [PDF]

- Areit Sugar Land CC LLC [PDF]

- AX Park8Ninety Castcom Comcast [PDF]

- Ben E Keith. 1st Restated [PDF]

- Ben E Keith. 2nd Restated [PDF]

- Ben E Keith. 3rd Restated [PDF]

- Braes Bayou Generating LLC [PDF]

- Carson-VA Industrial & Cookie Baker LLC [PDF]

- Champion X [PDF]

- CLB Inc [PDF]

- Cutlass Solar II LLC [PDF]

- Cutlass Solar LLC [PDF]

- Dairy Ashford Enterprise Inc & Bluebonnet Nutraceuticals Ltd [PDF]

- Dollar Tree Distribution Inc [PDF]

- DSK Holdings [PDF]

- EVOX.TDC-DRI Sugar Land LLC [PDF]

- Fairway Pines, Niagara Bottling, LLC [PDF]

- Frito-Lay Inc [PDF]

- Heavy HCSS Construction System Specialists Inc [PDF]

- HOU Ind, Best Buy Warehousing Logistics Inc [PDF]

- Imperial Linen Services [PDF]

- J Crosby Investments & CDand N Manufacturing, CNC Manufacturing [PDF]

- Marquez Enterprises [PDF]

- MCRPC II & Rich Products [PDF]

- Nalco Texas Leasing LLC [PDF]

- Old 300 Solar Center LLC [PDF]

- Old 300 Storage Center LLC [PDF]

- Ridge Southwest CC [PDF]

- Sage Dulles Ltd [PDF]

- TDC-DRI Sugar Land LLC [PDF]

- Texas Instruments Inc [PDF]

- TPP SW Commerce, Star Gessner Properties Ltd [PDF]

- Trinity Development LLC [PDF]

- Waterworld USA [PDF]