Debt Obligations Overview

Fort Bend County is committed to transparency and fiscal responsibility in managing its debt obligations. This summary provides an overview of the County’s current outstanding debt, including tax-supported debt and historical bond elections. The County does not have any outstanding revenue-supported debt obligations or lease-revenue obligation. Fort Bend County Toll Road and Fort Bend Grand Parkway Toll Road Authority Revenue bonds of $335 million and $165 million respectively are not reported here.

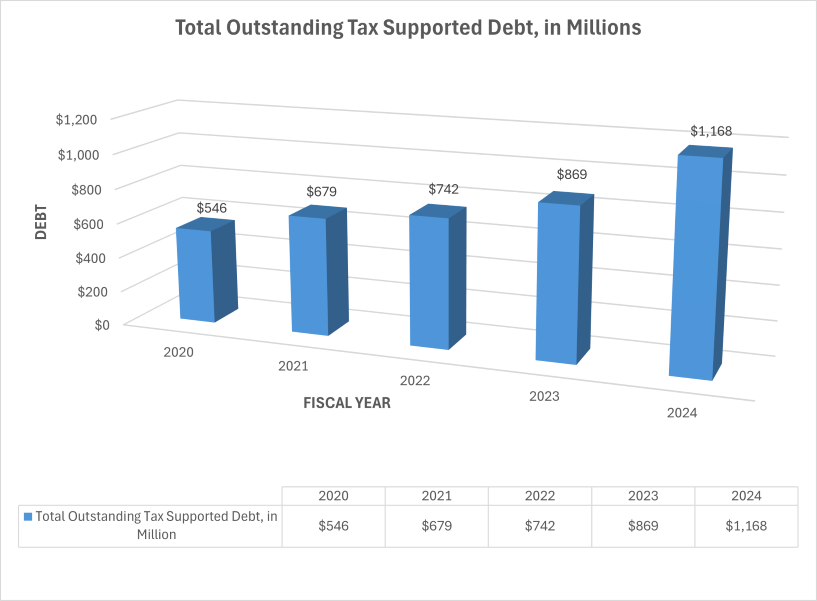

Total Outstanding Debt Obligations

As of September 2024, Fort Bend County’s total outstanding debt obligations are $1.2 billion. This figure includes tax-supported debt only.

Tax-supported debt refers to debt that is repaid using property tax revenues. Fort Bend County’s total tax-supported debt obligation currently stands at $1.2 billion. The outstanding debt at year end for the last five fiscal years is as follows:

Historical Bond Elections

Fort Bend County voters have supported various bond initiatives over the years to invest in infrastructure, public safety, and flood mitigation. Key bond elections include:

- November 2017 – $218.6 million mobility bond for continued transportation and roadway improvements.

- November 2019 – $83 million flood bond aimed at drainage and flood control projects.

- November 2020 – $218.2 million mobility bond and $38.4 million parks bond to expand and maintain parks and mobility infrastructure.

- November 2023 – $865.6 million in bonds:

- Proposition A: $712.6 million for mobility projects

- Proposition B: $153 million for parks and recreational improvements

Fort Bend County remains dedicated to prudent debt management practices that align with its long-term capital planning goals, ensuring that financial resources are used efficiently to serve the needs of its residents.

Documents

- Debt Policy [PDF]

- 2025 Annual Local Debt Report [XLSX]

- 2024 Tax Rate Summary [PDF]

- Five fiscal years debt information from adopted budgets

Downloadable Data

Other Information

- Bond review board local government debt database

- Fort Bend County currently does not have any upcoming bond elections.